Corporation Tax Exemption Hmrc . Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023 if your company’s profits. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes.

from www.ratednearme.com

Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023 if your company’s profits. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent.

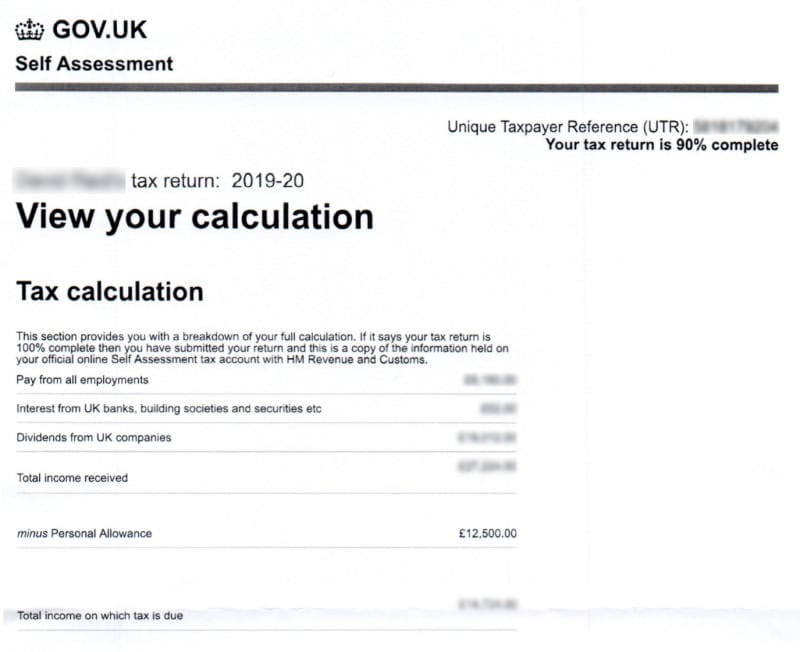

HMRC Tax Refunds & Tax Rebates 3 Options Explained

Corporation Tax Exemption Hmrc Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023 if your company’s profits.

From janes-creative-nonsense.blogspot.com

Hmrc Corporation Tax Registration Form Erin Anderson's Template Corporation Tax Exemption Hmrc Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web you can reduce. Corporation Tax Exemption Hmrc.

From support.freeagent.com

How to explain a Corporation Tax payment to HMRC FreeAgent Corporation Tax Exemption Hmrc Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web. Corporation Tax Exemption Hmrc.

From info.techwallp.xyz

Hmrc Letter Management And Leadership Corporation Tax Exemption Hmrc Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023. Corporation Tax Exemption Hmrc.

From www.pinterest.com

HMRC Tax Overview Corporation Tax Exemption Hmrc Web you can reduce your corporation tax bill through marginal relief from 1 april 2023 if your company’s profits. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas. Corporation Tax Exemption Hmrc.

From www.forres-gazette.co.uk

HMRC announce breathing space on late Self Assessment tax returns Corporation Tax Exemption Hmrc Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023. Corporation Tax Exemption Hmrc.

From businessadviceservices.co.uk

HMRC Arrears VAT/PAYE/Corporation Tax/CIS Business Advice Services Corporation Tax Exemption Hmrc Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web from. Corporation Tax Exemption Hmrc.

From taxhelp.uk.com

HMRC 2018 Tax Return Form Corporation Tax Exemption Hmrc Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023 if your company’s profits. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%.. Corporation Tax Exemption Hmrc.

From bloginyouth.com

A Guide to Corporation Tax who will pay it Blog In Youth Corporation Tax Exemption Hmrc Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web you can reduce your corporation tax bill through marginal relief from 1 april 2023 if your company’s profits. Web hmrc may. Corporation Tax Exemption Hmrc.

From businessadviceservices.co.uk

Sample HMRC Letters Business Advice Services Corporation Tax Exemption Hmrc Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web from 1. Corporation Tax Exemption Hmrc.

From www.aplustopper.com

Tax Exempt Certificate How to Get a Tax Exemption Certificate A Corporation Tax Exemption Hmrc Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web. Corporation Tax Exemption Hmrc.

From musicxluver.blogspot.com

Hmrc Am Enjoying Journal Lightbox Corporation Tax Exemption Hmrc Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies with profit. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main. Corporation Tax Exemption Hmrc.

From www.slideshare.net

Company tax computation format (1) Corporation Tax Exemption Hmrc Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web companies with taxable profit of £50,000 or less will be subject to corporation tax at the rate of 19% and companies. Corporation Tax Exemption Hmrc.

From exordfdhw.blob.core.windows.net

Corporation Tax Exemption Not For Profit at Megan Williams blog Corporation Tax Exemption Hmrc Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web you can reduce your. Corporation Tax Exemption Hmrc.

From fakeutilities.com

ukhmrctaxdocuments Corporation Tax Exemption Hmrc Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web the uk provides. Corporation Tax Exemption Hmrc.

From www.simmons-simmons.com

HMRC tax rates and allowances for 2021/22 Simmons & Simmons Corporation Tax Exemption Hmrc Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web from 1 april 2023, companies with. Corporation Tax Exemption Hmrc.

From www.youtube.com

HMRC Corporation Tax Paying Your Corporation Tax YouTube Corporation Tax Exemption Hmrc Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web it is possible to surrender or claim eligible corporation tax losses to/from other companies in the same group that. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web corporation tax rates the rate. Corporation Tax Exemption Hmrc.

From internationalfinance.com

6 reasons business should give bonus using HMRC tax exemption Corporation Tax Exemption Hmrc Web from 1 april 2023, companies with taxable profits over £250,000 will pay corporation tax at the main rate of 25%. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web it is possible to. Corporation Tax Exemption Hmrc.

From companydoctor.co.uk

Paying HMRC Corporation Tax A StepbyStep Guide for Directors Corporation Tax Exemption Hmrc Web the uk provides an elective exemption from uk corporation tax for the profits of an overseas permanent. Web hmrc may also class your unincorporated organisation, such as a members’ club, dormant for corporation. Web corporation tax rates the rate of corporation tax you pay depends on how much profit your company makes. Web from 1 april 2023, companies with. Corporation Tax Exemption Hmrc.